Official WeChat

Building Materials Industry Prosperity Index (MPI) for July 2025

I. Building Materials Industry Prosperity Index for July

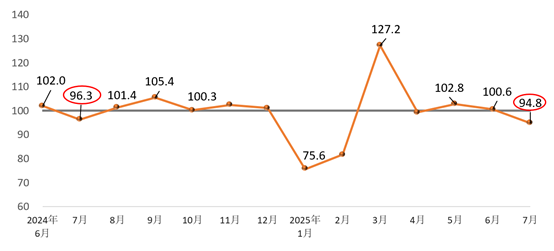

In July 2025, the Building Materials Industry Prosperity Index stood at 94.8 points, below the critical threshold and within the non-prosperity range. It decreased by 5.8 points compared to June and was 1.6 points lower than the same period last year, indicating a slowdown in the building materials industry.

Monthly Prosperity Index for the Building Materials Industry

On the supply side, both the price index and production index for the building materials industry in July were below the critical threshold. Specifically, the Building Materials Industry Price Index was 99.7 points, down 0.1 points from the previous month, while the Building Materials Industry Production Index was 95.1 points, down 5.6 points from the previous month. Overall, prices of building materials products slightly declined month-on-month, continuing a trend of low-level fluctuations, and production activity weakened.

On the demand side, the Building Materials Investment Demand Index and Industrial Consumption Index for the month were below the critical threshold, falling within the non-prosperity range, while the International Trade Index remained above the critical threshold, within the prosperity range. Specifically, the Building Materials Investment Demand Index was 93.9 points, below the critical threshold and down 6.4 points from the previous month, indicating weakened demand for building materials products in investment-related markets. The Building Materials Industrial Consumption Index was 97.7 points, down 5.5 points from the previous month, reflecting a decline in consumption demand from manufacturing sectors that utilize building materials products. The Building Materials International Trade Index was 101.5 points, down 2.3 points from the previous month, showing month-on-month growth in foreign trade of building materials. Overall, investment demand and industrial consumption growth slowed in July, while international trade demand continued to expand.

II. Analysis and Early Warning of MPI Influencing Factors

Seasonal weakening of demand in the building materials market has led to a slowdown in production. Influenced by seasonal factors such as high temperatures and rainfall, construction progress in infrastructure and real estate development has slowed, and production in related manufacturing sectors has weakened. As a result, market demand in the building materials industry has experienced a seasonal decline, and production has significantly slowed. In July, with the exception of sectors such as construction stone, architectural technical glass, mineral fibers, and composite materials, production in all other sectors fell within the non-prosperity range, indicating reduced production activity compared to the previous month.

Prices of building materials products slightly declined. In July, among the sub-sectors of the building materials industry, product prices increased month-on-month in seven sectors: cement, concrete and cement products, waterproof materials, lightweight building materials, thermal insulation materials, clay and sand mining, and mineral fibers and composite materials. Conversely, product prices decreased month-on-month in six sectors: wall materials, lime and gypsum, construction stone, architectural technical glass, architectural sanitary ceramics, and non-metallic minerals. Factory prices of products in three sectors—clay and sand mining, construction stone processing, and mineral fibers and products—maintained year-on-year growth. Overall, prices of building materials products continued to fluctuate at low levels.

Weakening market demand expectations necessitate vigilance against further exacerbation of supply-demand imbalances. Since the beginning of this year, the growth rate of national fixed-asset investment has continued to slow, with a year-on-year increase of 2.8% from January to June, down 0.9 percentage points from the previous month. Notably, fixed-asset investment in construction and installation engineering grew by only 0.1% year-on-year, down 1.1 percentage points from the previous month, indicating a significant slowdown. In response to "involutionary" competitive pressures, industries such as photovoltaics and new energy vehicles have implemented production limits or cuts, which will reduce demand for related building materials products and intensify supply-demand imbalances in the building materials industry. Building materials enterprises should strengthen market monitoring, organize production rationally, and respond cautiously. Additionally, as temperatures rise, thermal power generation increases, leading to slight increases in the prices of fuels such as coal and natural gas. This will raise energy costs for building materials enterprises in the short term. However, based on current supply-demand dynamics, coal inventory levels, and other factors, fuel supply is expected to remain stable, and prices are unlikely to experience significant increases.